Planning for early retirement is a dream for many Australians, … Continued

When, Why and How to change from Sole Trader to Company

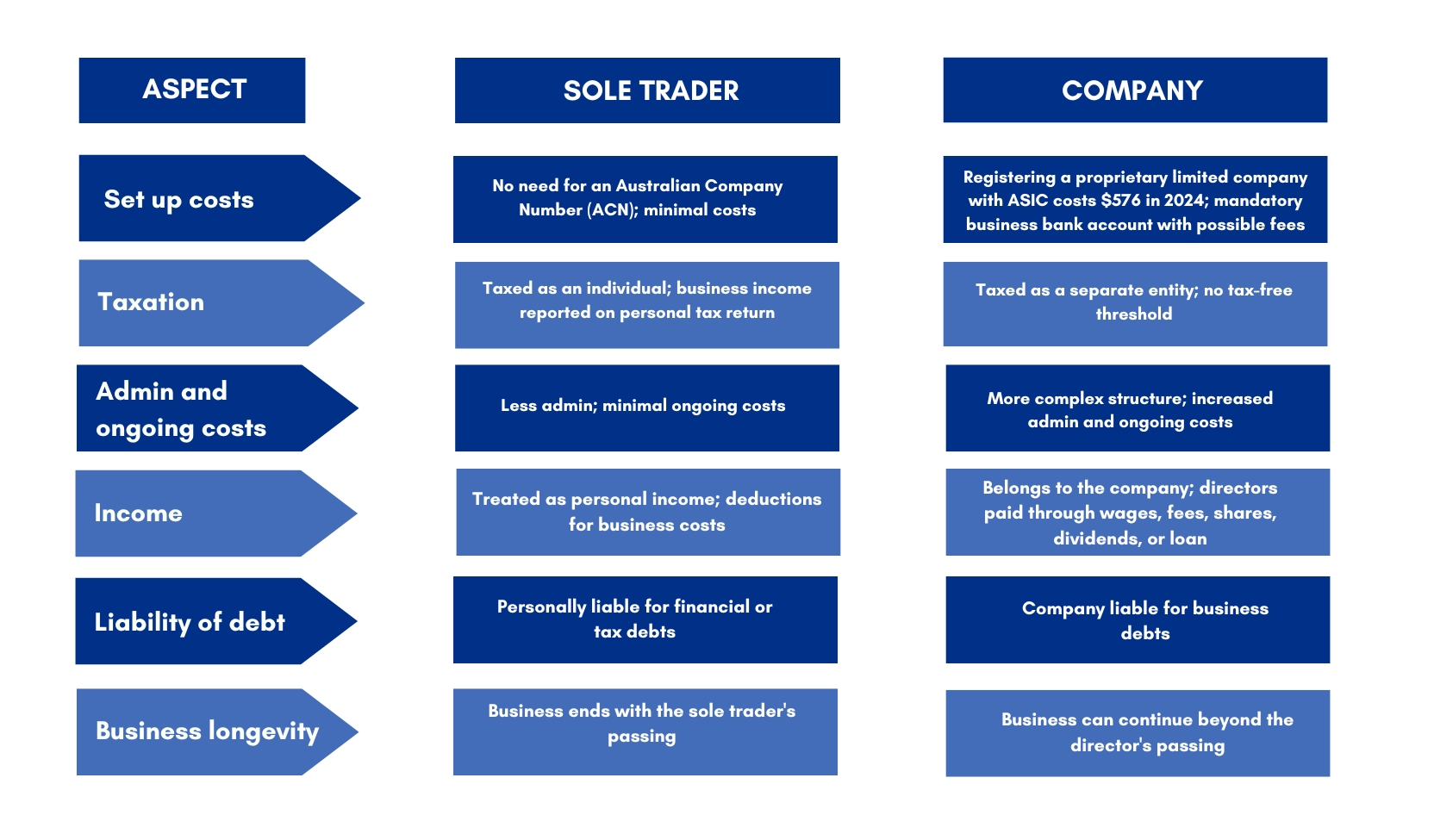

The decision-making process of “sole trader vs company” for your business structure can be confusing and stressful. Most people initially choose to start as a Sole Trader and in time start to earn more and as reach high marginal tax rates. Its when the business becomes bigger then themselves or at these times of income growth that business owners should be at least rethinking their structure.

The 3 main reasons you would consider changing your business structure are:

1. Growth: Is your business growing and no longer a one-person show? Switching to a company structure can help manage this growth more efficiently.

2. Liability: As a sole trader, you’re on the hook for everything. Moving to a company structure helps separate your personal and business liabilities for a lot of the risks—think of it as a protective bubble.

3. Tax: Depending which salary bracket you sit in, switching to a company could better your tax position. More money in your pocket means more to reinvest in your business.

What is a Sole Trader?

A sole trader is an individual who runs a business. As the ‘sole’ owner all decisions, from day-to-day operations to strategic planning, rest on their shoulders, offering complete autonomy and control. While a sole trader structure can be affordable and simple, it can be riskier because the owner is personally liable for the business. This structure has no legal distinction between the owner and the business. Consequently, any debts or liabilities the business incurs are directly attributed to the owner. If the business faces financial struggles or legal issues, the owner’s personal assets, such as their home or savings, could potentially be at risk of settling business debts.

Advantages of being a Sole Trader

- Less expensive to set up and maintain

- Only one tax return is required

- The business is entirely under your ownership, control, and management

Disadvantages of Operating with a Sole Trader Business Structure

- Your personal assets can be at risk if the business goes into debt

- Less flexibility for tax planning

- Businesses generating a high income have fewer opportunities to reduce taxes

- Retaining high-calibre employees can be difficult

- Limited capacity for growth

- The business ends when you pass away or retire

What is a Pty Ltd Company?

A proprietary limited company, often abbreviated as Pty Ltd, is a business structure where the business is its own legal entity. This means it has rights and responsibilities separate from those who own or run it.

Advantages of Running a Company

- Your personal assets are protected from company losses

- More flexibility for tax planning

- You can add investors or shareholders

- Ownership can easily be transferred by selling shares

- Raising capital for the company is easier to do

- Tax rates can be more favourable

- Potential credibility and permanency in the eye of stakeholders and clients, which might be particularly beneficial in certain industries or markets.

Disadvantages of Running a Company

- More expensive to set up and maintain

- Separate tax returns

- Winding up a business can be a slower

See below the key differences between Sole Trader & Company:

Steps to Transition from Sole Trader to Company:

1. Pick your name: First things first, pick a name for your new company. It needs to be unique and catchy—something that stands out in the crowd. Check its availability with the Australian Securities and Investments Commission (ASIC).

2. Structure Setup: Decide on your company’s structure. Will it be a Proprietary Limited Company (Pty Ltd) or something else, like a trust or partnership.

3. Register the Company: Partner with an accountant to establish the company so that its done right the first time.

4. ABN and TFN Time: You’ll need a new Australian Business Number (ABN) and Tax File Number (TFN) for your company. These are like your business’s unique identifiers—essential for everything from invoicing to tax returns.

5. GST and PAYG: Register for Goods and Services Tax (GST) by partnering with an accountant to set this up correctly.

6. Open a bank account: Open a business bank account in your company’s name. Keeping your finances separate is crucial for clarity and ease of management. Tip: You will need all of your new business details in order to set up a new business bank account, so the above order is important.

7. Asset Transfer: Transfer assets from your sole trader entity to the new company. This includes everything from property and equipment to intellectual property. It’s like moving house but for your business.

8. Update Contracts: Review and update contracts, leases, and agreements to reflect the new company structure. This ensures everyone knows they’re now dealing with a company, not just you.

9. Employee Essentials: If you have employees, update their contracts to the new company. Also, make sure their superannuation and tax arrangements are transferred correctly.

10. Spread the Word: Notify your clients, suppliers, and relevant authorities about your new company structure and updated bank account details. Think of it as a business re-launch—celebrate the milestone!

Wanting to know if a Company Structure is right for you? Start a conversation with us today.

Changing from a sole trader to a company structure is a significant step and can take time, Cosca is here to help for those looking to understand the process better or needing a professional to do the process on your behalf.