From 1 July 2024, the Australian Government is rolling out some major tax cuts that will see more cash in hand for most Australians come the new Financial Year. This blog post will break down what these changes mean for everyone, especially for those seeking financial services and tax advice. Understanding these tax cuts can help you make the most of your hard-earned money and ensure you’re getting the best financial support from your accountant.

What exactly is changing from July 1, 2024?

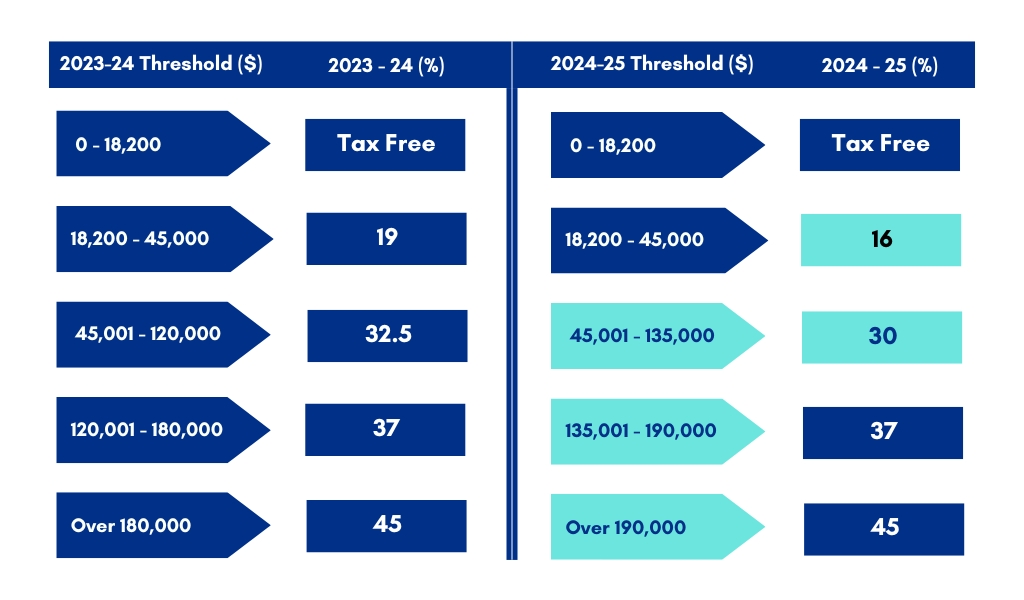

- Tax Rate Reductions

- Shifting Income Thresholds

See table below highlighting 2023-24 vs 2024-25 Tax Rate & Threshold Changes

What’s in it for Taxpayers?

These changes are designed to benefit everyone, helping individuals and families hold on to more of their hard-earned money. The changes are targeted to help with the cost of living and boost economic growth. We understand that every dollar counts, and we can see that these changes are a step in the right direction for financial relief.

Breaking Down the Benefits

- Low-Income Earners: Folks in the lowest tax bracket will see immediate perks with a lower tax rate, meaning more take-home pay.

- Middle-Income Earners: Those in the middle brackets will enjoy significant relief, slashing their overall tax bill.

- High-Income Earners: While the spotlight is on middle and lower-income earners, high-income taxpayers will also gain from the new thresholds and reduced rates.

These changes kick in for all taxable income earned from 1 July 2024, so they won’t affect your 2023–24 tax return. Please speak to your accountant to better understand how these changes will impact your financial situation and best practises moving forward.

The Long Game

By lowering the tax burden, the government hopes to boost spending and investment, fuelling economic growth and making the economy more robust. For businesses, this can mean increased consumer spending and more opportunities for growth.

Getting Ready for the Changes

- Check Your Tax Situation: Understand how these changes affect your personal tax. A chat with your resident tax professional can help you navigate the new structure and make the most of the benefits. The right accountant will provide clarity and advice tailored to your financial needs.

- Revamp Your Financial Plans: With extra cash on hand, think about how you can best use these funds. Savings, investments, or personal goals – the choice is yours! Ensuring you have good financial services support to assist you in making the most of your increased disposable income.

Are you needing help to navigate these changes? Whether you need advice on how the new tax rates will affect you or you’re looking for comprehensive financial services and planning, our team is here to support you. Call us today and speak with one of our friendly team members to schedule a free discovery call.