All of the below is subject to the legislation passing parliament and is in no way or form guaranteed.

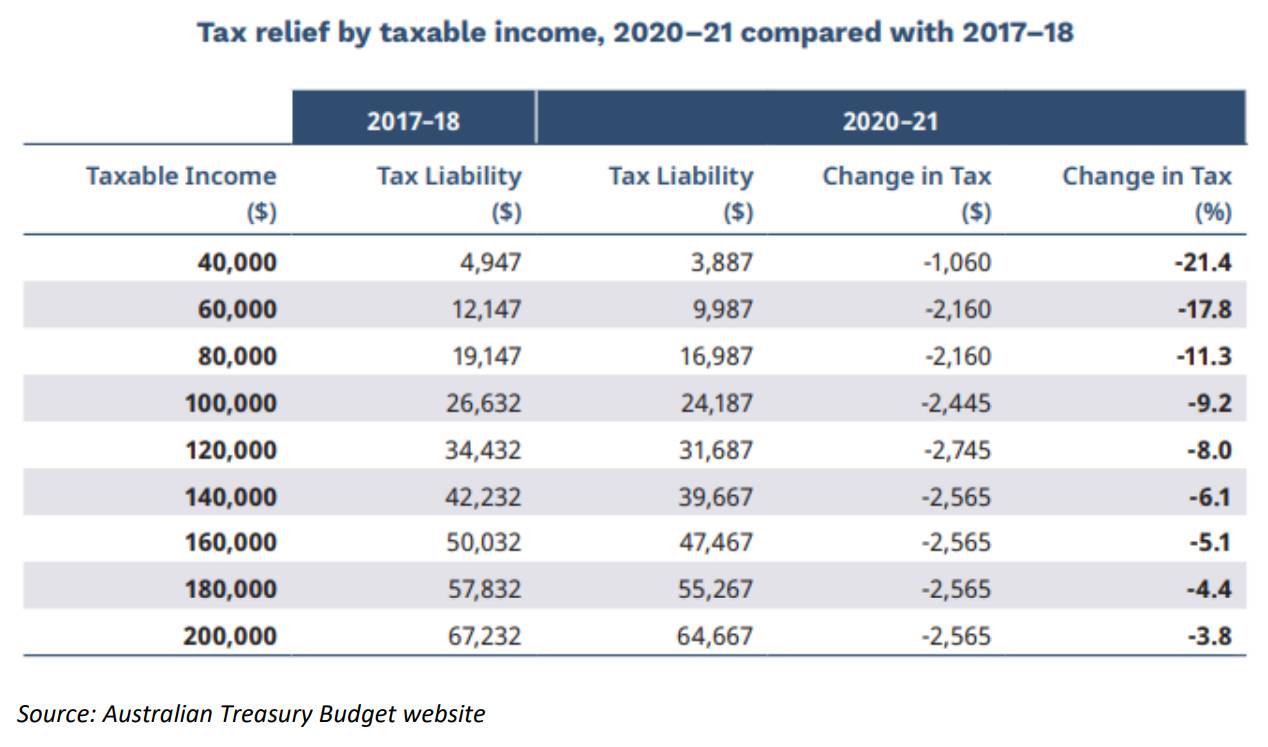

Tax Cuts (almost across the board)

- $45-90,000: Low and Middle Income Tax Offset (LMITO) to remain for the FY20. So that means up to $1,080 less tax per year.

Tax Cuts Slated for 2022 brought forward and back dated to July:

- Upper limit of the lowest 19 per cent Tax threshold raised from $37,000 to $45,000

- Cut-off for 32.5 per cent tax band lifted from $90,000 to $120,000

Payments for Pensioners

Two more tax-free payments of $250 to pensioners and others on Government Support. Payments will be in November and early next year.

The full list includes people on the:

- Age Pension

- Disability Support Pension

- Carer Payment

- Family Tax Benefit, including Double Orphan Pension (not in receipt of a primary income support payment)

- Carer Allowance (not in receipt of a primary income support payment)

- Pensioner Concession Card holders (not in receipt of a primary income support payment)

- Commonwealth Seniors Health Card holders

- Eligible Veterans’ Affairs payment recipients and concession card holders

First Home Buyers

- First home loan deposit scheme to be extended to June 2021 and the Price cap adjusted from $700k to $850k for Melbournites.

Private Health

- Increase in the age limit that a child can remain on your private health policy to age 30.

Granny Flat CGT Exemption:

Set to apply from July 1, 2021, where a formal written agreement is in place between the tenants and owners of a Granny flat, the Granny Flat will be subject to CGT exemptions. The rules covers agreements entered into because of family relationships or other personal ties.

Contact Us