By Chris Castles

“I own an investment property that I bought for $450,000, but if I sold it now I’d only get $300,000 for it. As soon as it gets back to what I paid for it I’m going to sell it.”

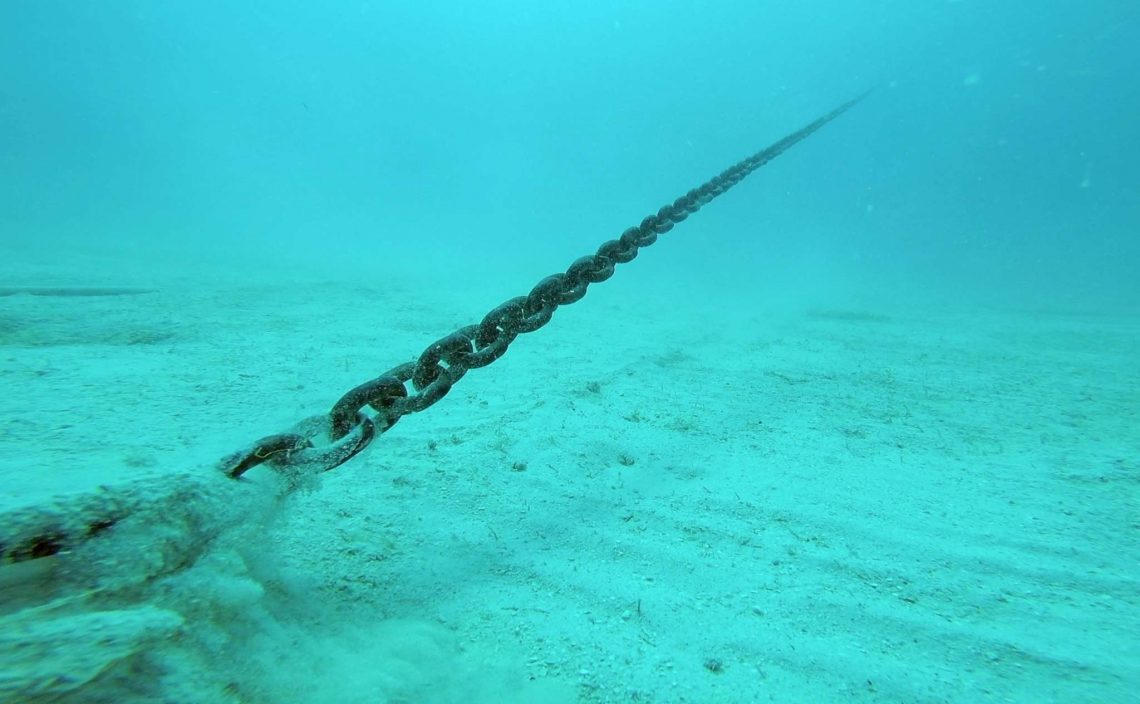

Ever heard something like that before? I’m sure we all have. That’s an example of ‘Anchoring’, which is a common investor bias that can be responsible for us losing a lot of money.

Anchoring is where we effectively fixate on a fact or figure that has no rational reason to factor into our decision. In the example above there’s no reason to focus on what was paid for the property. If it was going to take 100 years to get back to what we bought it for would you still hold out for the purchase price? I’ll bet not, and neither would I.

Anchoring doesn’t have to be just related to the price that you’ve paid for something though. Dan Ariely, author of ‘Predictably Irrational’, conducted an experiment which showed that by simply getting people to write down the last two digits of their social security number, and then having them bid on an item, it’s possible to get people with higher numbers to bid up to twice as much as their lower number companions. The brain unconsciously sets the social security number as the reference point, and the rest is history.

That’s worth thinking about, especially the next time you bid at an auction or go to buy some shares. Something as simple as house numbers or the last telephone number you dialled may just have a big impact on your financial decisions.

Need help untying the anchor? Call us on 1800 283 895.

Contact Us