By Mitchell Pratt

You may have noticed some volatility within financial markets of late, and with that volatility you can be forgiven for cringing when financial markets drop by 5-10% over a week. When it happens do you find yourself re-thinking your financial plan? If you do, would you re-think your financial strategy when financial markets go up by 5-10%? The reality is; probably not.

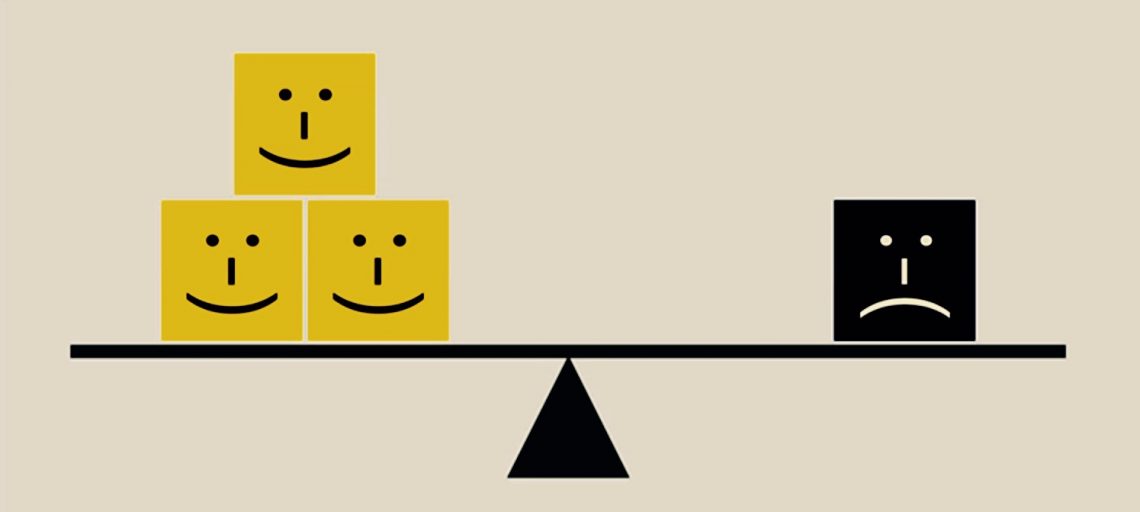

Negativity Bias is a concept that even when two events of the same magnitude occur, things of a more negative nature have a greater impression on our mindset than do any positive or even neutral events. We can all relate to that, whether it’s through simple day-to-day items like reading reviews on hotels. Even if a hotel has over 1,000 great reviews and only 10 negative reviews, we focus our time and decision on the negative ones – making sure we don’t have the same experience.

So how do we combat against Negativity Bias to ensure we are making the best possible decision? For starters, you need to understand how your brain is wired. It’s wired in a way to continually be afraid and to keep you constantly on guard – that’s how we managed to survive all these years! But when it comes to financial markets and your financial future, you need to be entirely objective. Which, for someone managing their own affairs can be a complex process at best, that’s where a financial planner comes in.

Your financial planner should be someone you’re comfortable (sounding out ideas with/) bouncing ideas off and someone you feel comfortable to talk to, when you’re uncomfortable. If you would like to know more, or begin to get your financial affairs in order, contact Cosca on 1800 283 895.

Contact Us