Running a small business involves more than just making profits. It’s also about having enough money to keep things running smoothly. That’s where “cashflow” comes in – it’s the flow of money in and out of your business.

Cashflow and profit are both important aspects of a business’s financial health, but they focus on different things. Profitability measures the surplus of revenue over expenses, indicating whether a business is earning more than it’s spending.

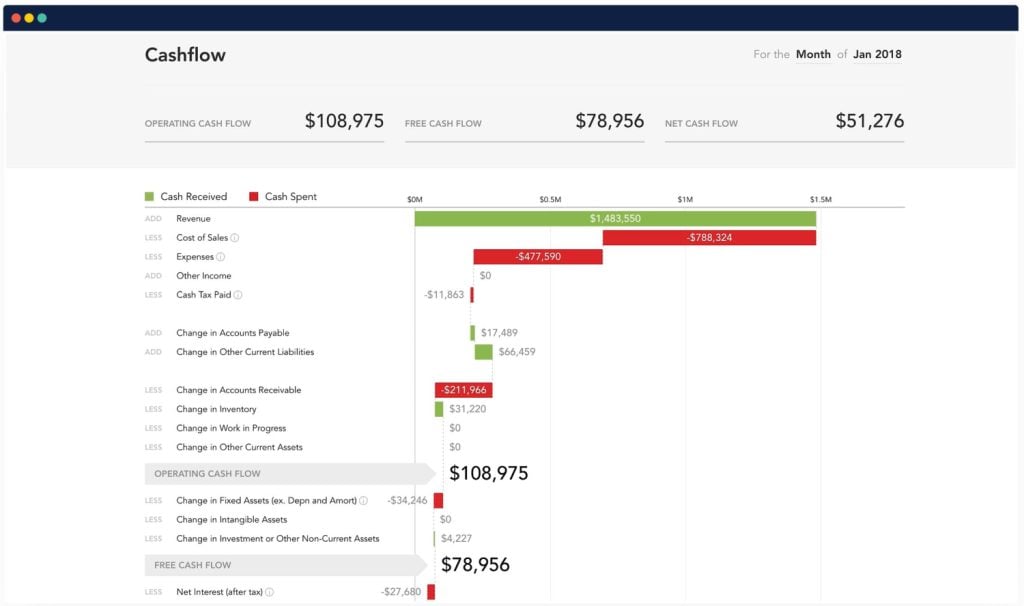

On the other hand, cashflow tracks the actual movement of money in and out of the business, showing how much cash is available at any given time to cover immediate obligations and investment requirements.

In simpler terms, profit is like the scorecard of a game, while cashflow is the actual money you have in your pocket to keep playing. It’s possible for a business to be profitable but still face cashflow issues if money isn’t coming in when it’s needed to cover expenses. Believe it or not, a small business can be profitable, but still have to close their doors due to cashflow management problems.

Understanding both profit and cashflow helps businesses make well-informed decisions, ensuring they have enough money to operate, grow, and thrive.

Here’s why cashflow is a big deal:

- Paying the Bills: You need cash to pay your bills like rent, salaries along with many other operating expenses. Cashflow helps you make sure you’ve got money when bills come in.

- Growing Smart: If your business is growing, that’s awesome! But remember growing costs money. Hiring more people and buying more assets all require additional upfront cashflow.

- Dealing with Loans: If you borrowed money for your business, you have to pay it back. Cashflow helps you figure out how to do that effectively without any money headaches.

- Spending Wisely: Sometimes you need to buy new things for your business, like tools or a better place to work. Cashflow helps you decide if you can buy these things without causing money troubles.

- Getting Ready for Surprises: Businesses can have tough times. Cashflow helps you be ready for surprises – like if sales suddenly go down – You need enough cash to keep going.

- Saving Your Cash: When you watch your cashflow, you can see where you’re spending too much. That means you can save money and make your business work even better. Spare cash can allow you to jump on any upcoming business opportunities.

Remember, making money is important, but understanding cashflow is like having a money safety net. It helps you pay bills, handle growth, manage loans, spend smartly, and stay strong when things get bumpy. If you’d like to understand your cashflow and get the tools in place to regularly monitor it, speak to one of our Business Advisers today by filling in the form below.

Get in touch today

Contact Us

Photo by Andre Taissin on Unsplash

Contact Us